Sales Report

Comprehensive Sales Report

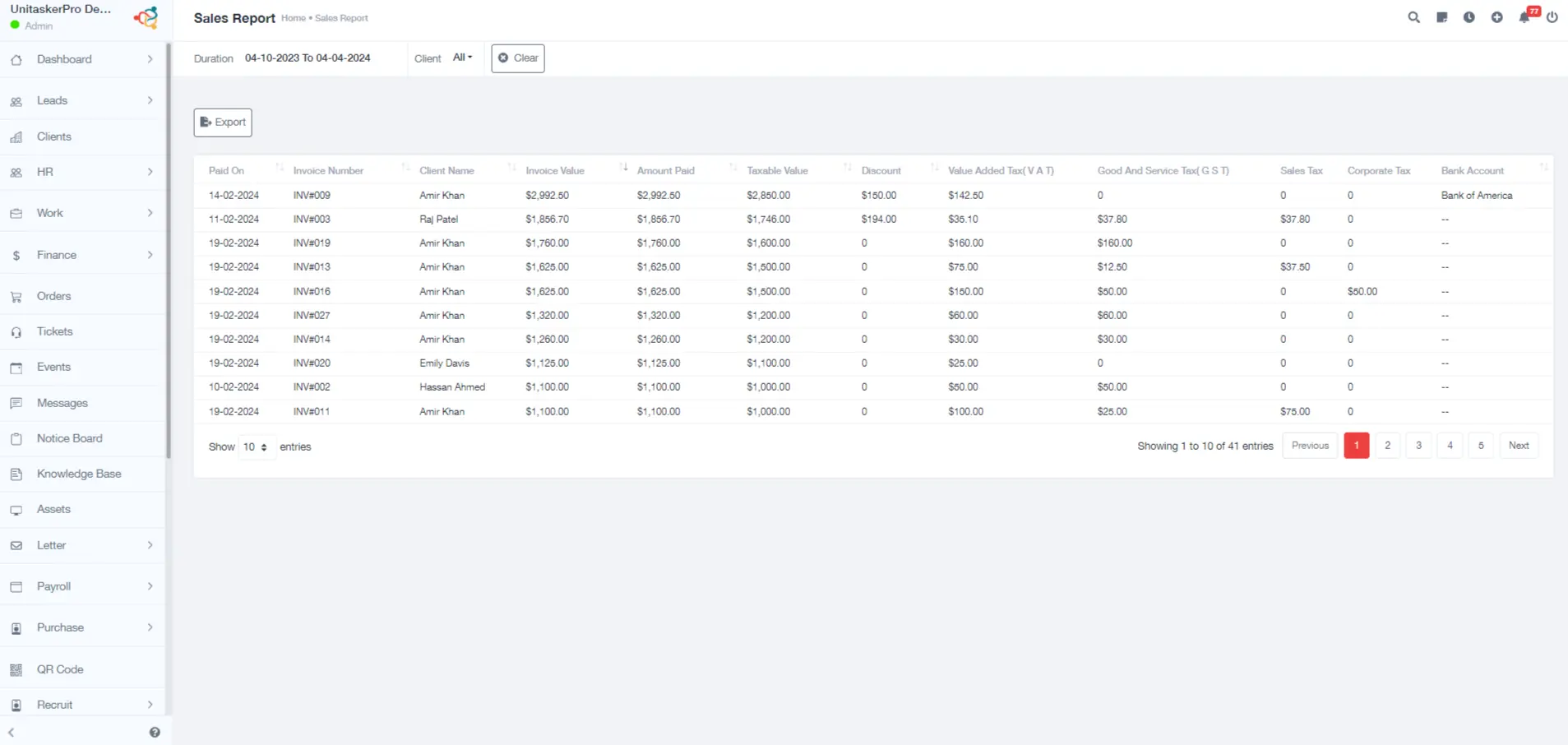

The Sales Report feature in UniTaskerPro provides users with a comprehensive overview of sales performance, offering insights into various aspects of sales transactions. By compiling data such as payment details, invoice information, client names, invoice values, amounts paid, tax breakdowns, and bank account details, this report assists organizations in analyzing sales performance, tracking revenue generation, and managing financial transactions effectively.

Payment Details:

- The report includes payment-related information, such as the date of payment (paid on), amount paid, and bank account used for payment.

- This data provides insights into the timing of payments, payment methods used, and cash flow management.

Invoice Information:

- Each sales transaction is associated with an invoice number, providing a reference point for tracking and reconciling transactions.

- Invoice values represent the total amount billed to clients for goods or services rendered.

Client Names:

- The report includes the names of clients or customers involved in each sales transaction, facilitating client relationship management and communication.

Tax Breakdown:

- Sales transactions often involve various taxes, such as VAT (Value Added Tax), GST (Goods and Services Tax), sales tax, and corporate tax.

- The report provides a breakdown of taxable values, tax amounts, and applicable tax rates for each transaction, ensuring compliance with tax regulations and facilitating tax reporting.

Discounts:

- The report may include information on discounts applied to sales transactions, providing insights into pricing strategies and promotional activities.

Bank Account Details:

- Information about the bank account used for receiving payments is included in the report, enabling organizations to track revenue sources and manage financial accounts effectively.